workers comp filing taxes

Union Workers Comp Lawyers Help Workplace Accident Victims File Claims for Benefits With a population just over of 56000 Union Township is one of the most populous in the state of New. Amounts received as workers compensation for an occupational sickness or injury are fully exempt from tax if paid under a workers compensation act or a.

6 800 1 Workers Compensation Program Internal Revenue Service

While workers compensation payments are considered income theyre not subject to an income tax and you dont need to report them on your IRS forms.

. Workers compensation benefits and settlements are fully tax-exempt meaning you do not have to pay taxes. According to the 2018 Publication 525 from the IRS amounts received from workers compensation for work-related. Paper claim forms should be filed only if computer access is not available.

Although workers compensation is not taxable you are still required to file a return if the income you earned in addition to your workers compensation meets the IRS filing requirements. The quick answer is that generally workers compensation benefits. In fact mos See more.

File Quarterly Reports. Our workers compensation services provide efficiencies by having premiums based on your actual payroll deducted automatically from each payroll cycle. IRS Publication 525 pg.

Compensation payments made via the Federal Employees Compensation Act FECA are generally not taxed. Workers compensation benefits are not classified as taxable income. Workers comp filing taxes.

LI has a program to help. If you have been injured as a result of an occupational accident. Now that we have a better understanding of what workers compensation is lets discuss how it is taxed.

Free Consultation 702 384-1414. 4 Easy Tips for Workers Comp. Most people with SSDI and workmens compensation income still fly under the radar of making less than the requirement to file taxes.

The answer to your question regarding workers comp is no. Nj workers compensation NJ Attorney Blog NJ Lawyer Blog Simon Law Groups latest Info News and Updates. When your employees are receiving workers compensation benefits they may wonder if theyll have to pay taxes on them.

Many businesses are facing financial strain due to the economy natural disasters pandemic or other serious problems. In most cases its not. A Workers Compensation Managed Care Organization WCMCO is any entity that manages the utilization of care and.

However if you resume work for any amount of time including on light duty you will. Is Workers Compensation Considered Income When Filing Taxes. Its tax season and if you received workers comp benefits last year you may be wondering if that money is taxable.

Thursday October 13 2022. Your workers compensation benefits over an entire tax year will remain non-taxable. These benefits are intended to replace lost wages and are not considered to be additional income.

Bramnick Rodriguez Grabas Arnold Mangan LLC helps injured employees in Clifton NJ file workers compensation claims for benefits. How Does Workers Comp Affect Tax Return. As we mentioned earlier workers compensation is not considered taxable income most of the time.

Filing a claim for workers compensation benefits electronically in ECOMP. However the payments that are made for up to 45 days while the. This is one of the reasons why injured employees are only paid two-thirds of their pre-injury weekly wages.

Should I File Taxes This Year If I Am On Workers Compensation Don T Work

How To Start A Business In The Us Taxes And Legal Requirements Printful

Workers Comp Settlements In Pennsylvania Calhoon And Kaminsky P C

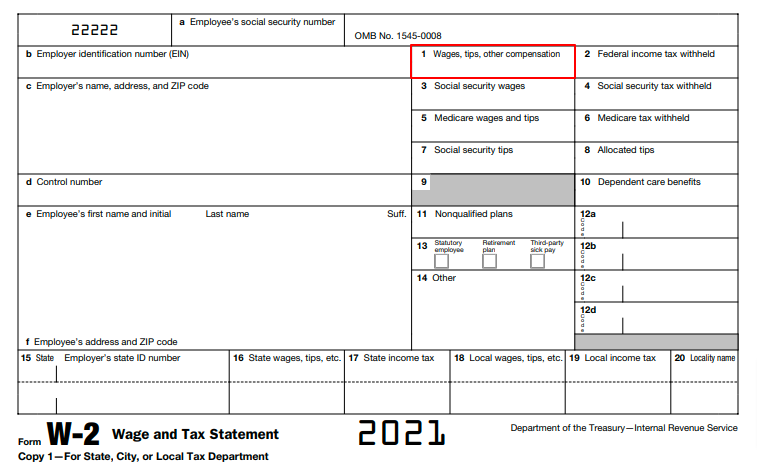

Form W 2 Box 1 Guide For Navigating Through Confusing Discrepancies

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Is Workers Comp Taxable What To Know For 2022

7 Tax Season Tips For Cleaning Businesses Insureon

Should I File Taxes This Year If I Am On Workers Compensation Don T Work

Is Workers Comp Taxable Do You Have To File Workers Compensation Income On Tax Returns Are Workmans Compensation Settlements Taxable

Georgia Workers Compensation Benefits Are They Taxable

Workers Compensation And Taxes James Scott Farrin

Do I Have To Pay Taxes On My Weekly Workers Compensation Benefits Or Settlement

Do I Have To Pay Taxes On A Workers Compensation Settlement Workers Compensation Lawyers Ben Crump

Can You File Your Taxes Twice What You Need To Know

Are Workers Compensation Settlements Taxable

How Workers Compensation Insurance Works Forbes Advisor

Do I Pay Taxes On My Workers Compensation Settlement In Ohio

Your Guide To The W 2 Form Wage And Tax Statement Hourly Inc